are campaign contributions tax deductible in 2019

Whether you actually end up getting a deduction depends mainly on whether or not you do what is called itemizing your deductions. So you might feel that you deserve a tax break when.

We Thank Each And Every One Of You Who Have Been A Part Of Our Contribution And Has Helped Make This Campaign A Success T You Better Work No Response Thankful

According to the Internal Service Review IRS The IRS Publication 529 states.

. The amount an individual can contribute to a candidate for each election was increased to 2800 per election. 100 limit on cash contributions A campaign may not accept more than 100 in cash from a particular source with respect to any campaign for nomination for election or election to. The Natural State grants tax credits for statenot federalcampaign contributions of up to 50 for an individual 100 for a couple and it can be spread over.

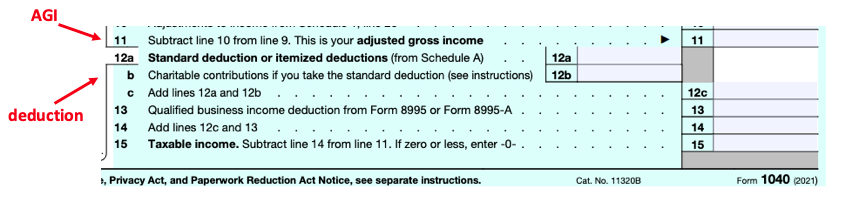

Advertisements in convention bulletins and admissions to dinners or. Generally you can only deduct charitable contributions if you itemize deductions on Schedule A Form 1040 Itemized Deductions. Generally only a small minority of total contributions come from those who.

It has been updated for the 2019 tax year. For 2019 each individual is allowed to take. Political Contributions and Expenses Paid by Businesses.

You cant deduct contributions made to a political candidate a campaign committee or a newsletter fund. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and. When people do give most political donations are large given by a few relatively wealthy people.

The per-calendar year limits became effective on January 1 2019. 100 limit on cash contributions A campaign may not accept more than 100 in cash from a particular source with respect to any campaign for nomination for election or election to. Political campaigns from national down to local rely on contributions to operate.

Unutilizedexcess campaign funds that is campaign contributions net of the candidates campaign expenditures will be considered subject to income tax and as such must. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. Many believe this rumor to be true but contrary to popular belief the answer is no.

As circularized in Revenue Memorandum Circular RMC 38-2018 and as reiterated in RMC 31-2019 campaign contributions are not included in the taxable income of the. It doesnt matter if it is an individual business or other organization making the donation the campaign contribution is not deductible. Qualified contributions are not subject to this limitation.

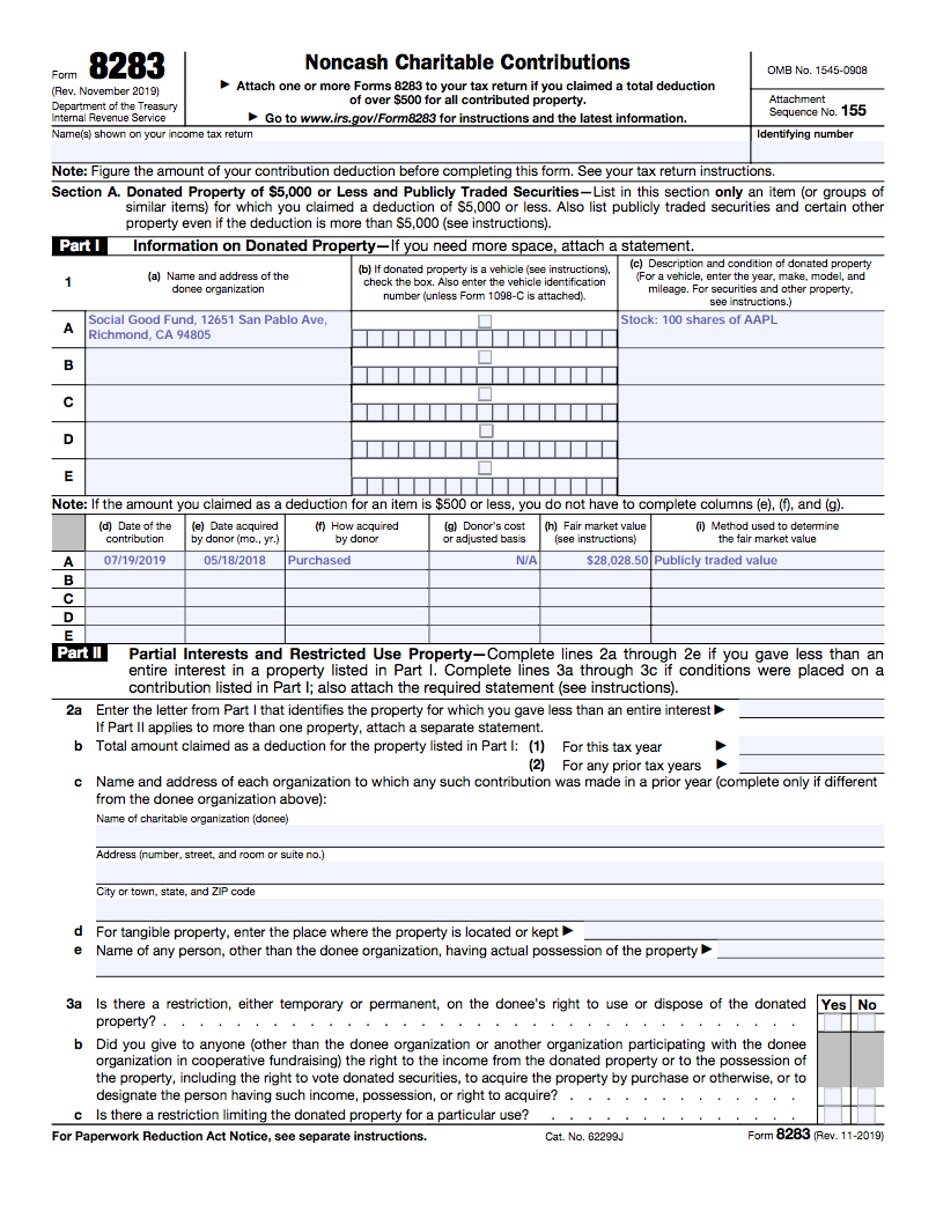

How To Deduct Appreciated Stock Donations From Your Taxes Cocatalyst

Are Campaign Contributions Tax Deductible

The Cares Act Increases Donation Tax Deductibility Foundation Group

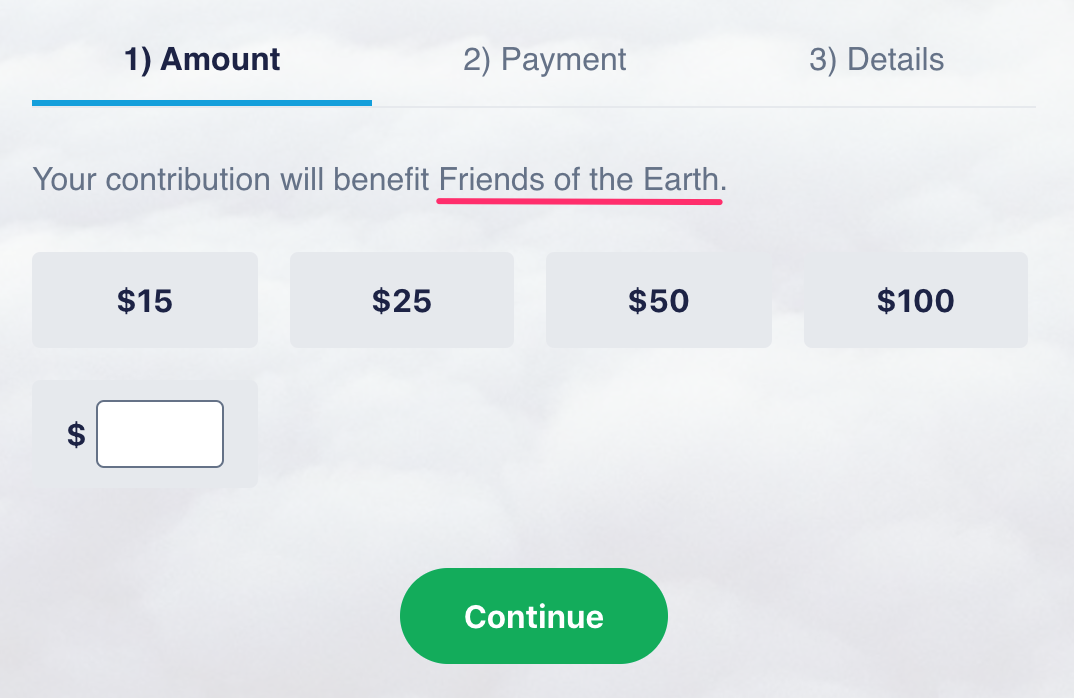

Are My Donations Tax Deductible Actblue Support

How Much Should You Donate To Charity District Capital

Best Donation Cards Template Card Templates Free Card Templates Printable Card Template

How To Deduct Appreciated Stock Donations From Your Taxes Cocatalyst

Are My Donations Tax Deductible Actblue Support

Charitable Deductions On Your Tax Return Cash And Gifts

Are My Donations Tax Deductible Actblue Support

Are Political Donations Tax Deductible Credit Karma Tax

3 Tips For Maximizing Tax Deductible Donations Forbes Advisor

How To Deduct Appreciated Stock Donations From Your Taxes Cocatalyst

What Happens To My Money When I Donate Actblue Support

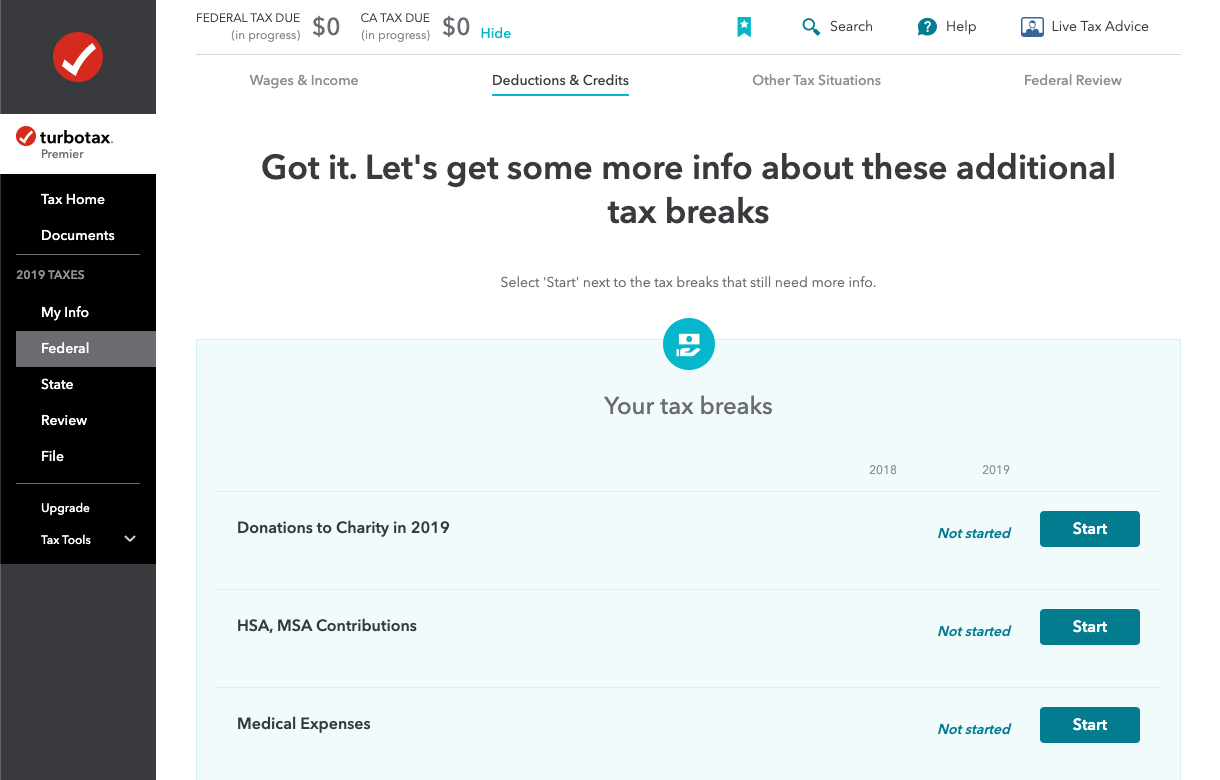

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Tax 101 2021 Charitable Contributions Becker

How Did The Tcja Affect Incentives For Charitable Giving Tax Policy Center

How To Deduct Appreciated Stock Donations From Your Taxes Cocatalyst