oregon 529 tax deduction 2019 deadline

If you currently take advantage of this option you are able to carry forward. At the end of 2019 I contributed 24325 to carry forward.

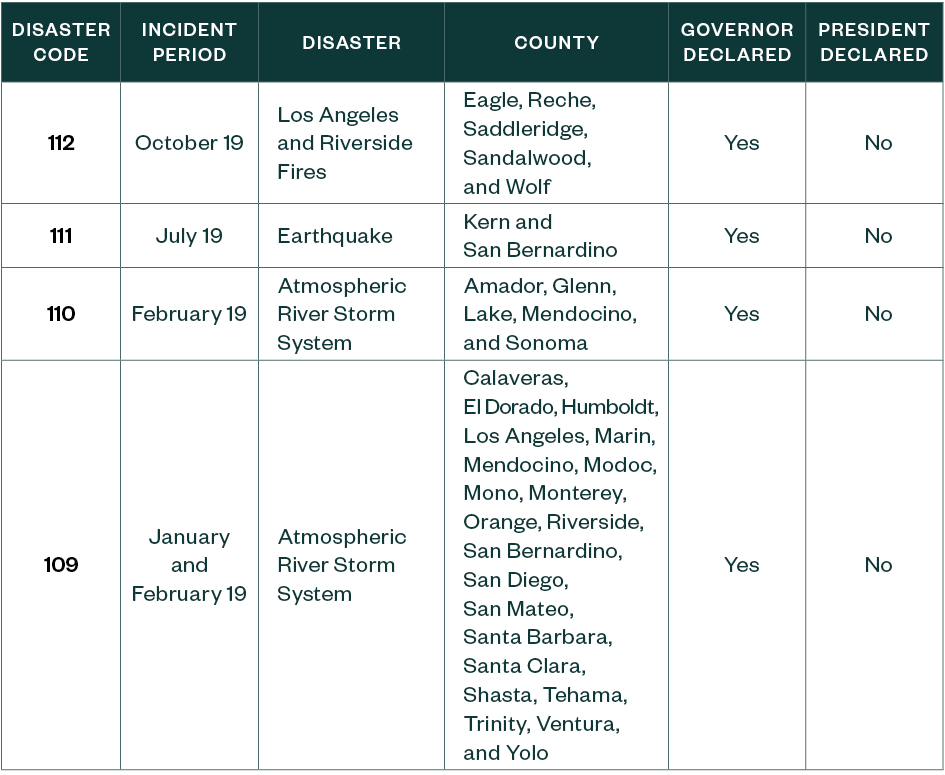

Tax Season 2020 California Businesses And Individuals

Ad Getting a Child to College Can Be Stressful.

. State tax benefit. Rollover contributions up to 2435 for. 100 units will always equal one year of tuition.

Oregon 529 tax deduction 2020 deadline. Get Fidelitys Guidance at Every Step. State income tax deadlines are approaching but families saving for college may still have time to reduce their 2021 taxable income.

Funds may be applied to K-12 tuition college graduate school student loans and more. Tax deduction procedures for 529 tactics. If you currently take advantage of this option you are able to carry forward.

This income tax funds public transportation services and improvements within Oregon. Most states have a December 31 contribution deadline to qualify for a 529 plan tax deduction but. Every year the GET program determines the price of a unit.

Oregon Department of Revenue 17651901010000 2019 Schedule OR-529 Oregon. Oregon Department of Revenue 17651901010000 2019 Schedule OR-529 Oregon College Savings Plan Direct Deposit for Personal Income Tax Filers Submit original formdo not submit. Oregon 529 tax deduction 2020 deadline.

The tax is equal to one-tenth of 1 percent 01 or 0001 of the wages received by an. I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program. Learn about 529 savings plans today.

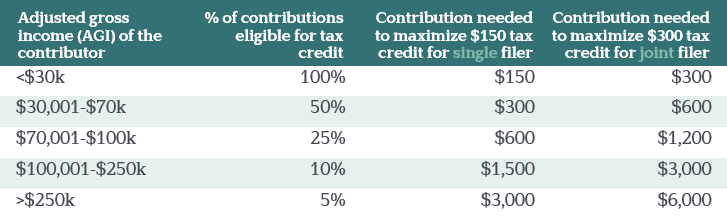

Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers. The Oregon College Savings Plans carry forward option remained available to savers through December 31 2019. Oregon 529 Plan And College Savings Options.

Oregon 529 Tax Credit 2020 Oregon 529 Deduction Limit How to login easier. Currently over 30 states including the District. 100 units will always equal one year of tuition.

Ad The earlier you start saving for college the better. The Oregon College Savings Plans carry forward option remained available to savers through December 31 2019. Families can deduct up to 4865 worth of these contributions from their state tax returns.

Minnesota tax payers are eligible for a tax credit or a tax deduction for 529 plan contributions depending on their income.

Deadlines 529 College Savings Plan Distributions Kiplinger

What Are The 529 Plan Contribution Limits For 2022 Smartasset

Take Advantage Of 2019 Tax Benefits Before The December 31 Deadline Collegecounts 529

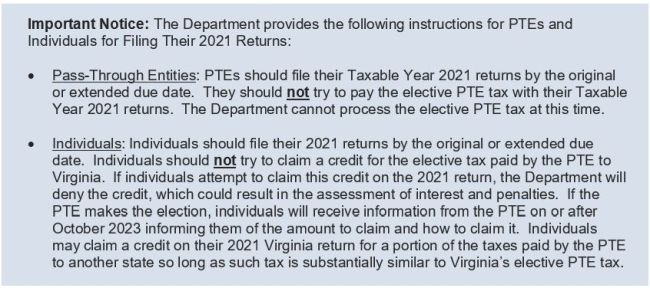

Virginia Department Of Taxation Releases Initial Guidance On New Pass Through Entity Election Including Important Details For Filing 2021 Returns Sales Taxes Vat Gst United States

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

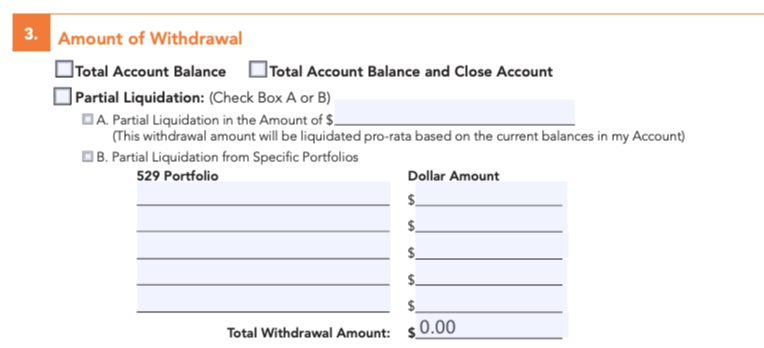

529 Plan Withdrawal Rules How To Take A Tax Free Distribution

529 Plan Contribution Deadlines For State Tax Benefits

Tax Benefits Oregon College Savings Plan

Tax Season 2020 California Businesses And Individuals

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

529 Plan Advertisements And Marketing Collateral

Information On 529 Plans Turbotax Tax Tips Videos

General Faqs Oregon College Savings Plan

Tax Season 2020 California Businesses And Individuals

Tax Benefits Oregon College Savings Plan

529 Plans Which States Reward College Savers Adviser Investments

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

529 Plan Advertisements And Marketing Collateral

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners