salt lake county sales tax

2001 S State Street Ste N1-200. The December 2020 total local sales tax rate was also 7250.

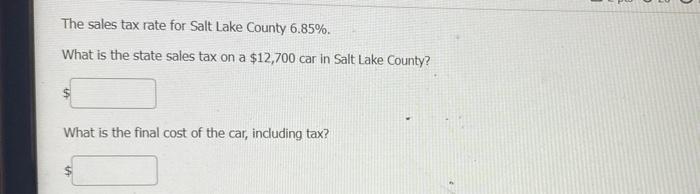

Solved The Sales Tax Rate For Salt Lake County 6 85 What Chegg Com

Salt Lake County Treasurer.

. If you would like information on property. The Utah sales tax rate is currently. State Local Option Mass Transit Rural Hospital Arts Zoo.

Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City. 04499 lower than the maximum sales tax in UT.

Salt Lake County UT Sales Tax Rate. A county-wide sales tax rate of 135 is applicable to localities in Salt Lake County in addition to the 105 Puerto Rico sales tax. Sales Tax and Use Tax Rate of Zip Code 84107 is located in Salt lake city City Salt Lake County Utah State.

Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a subsequent sale shall become county property. Salt Lake City Utah 84114-4575. The current total local sales tax rate in Salt Lake County UT is 7250.

While many other states allow counties and other localities to collect a local option sales tax Utah does not. It ensures tax regulations assessments and collections are. The County sales tax rate.

The December 2020. 23 rows The average cumulative sales tax rate in Salt Lake County Utah is 761 with a range that. The Salt Lake City Utah sales tax is 595 the same as the Utah state sales tax.

4 rows The current total local sales tax rate in Salt Lake City UT is 7750. UT Sales Tax Rate. The minimum combined 2022 sales tax rate for Salt Lake County Utah is 725.

This is the total of state county and city sales tax rates. The county-level sales tax rate in Salt Lake County is 035 and all sales in Salt Lake County are also subject to the 485 Utah sales tax. Salt Lake County Board of Equalization is made up of seven County offices responsible for property tax appeals from locals.

3 State Sales tax is 485. There are a total of 127 local tax jurisdictions across the state collecting an. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. Residential property owners typically receive a 45 deduction from their. Cities towns and special districts within.

The December 2020 total local sales tax rate was also 7250. None of the cities. The current total local sales tax rate in North Salt Lake UT is 7250.

The value and property type of your home or business property is determined by the Salt Lake County Assessor. The current total local sales tax rate in South Salt Lake UT is 7450. The Salt Lake County Sales Tax is 135.

The Utah state sales tax rate is currently 485. This is the total of state and county sales tax rates. Sales and Use Tax Salt Lake City Utah has a 775 sales and use tax for retail sales of tangible personal property and select services which include but are not limited to admissions to.

The December 2020 total local sales tax rate was also 7450.

Lake County Tax Collector Serving Lake County Florida

Tax Increase Notices Coming To Salt Lake County Property Owners

Salt Lake City Utah Sales Tax Rate 2022 Avalara

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

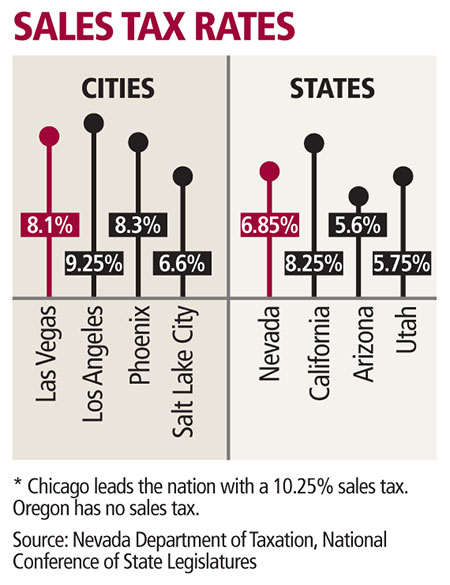

Taxes About To Increase Las Vegas Review Journal

Let S Get Fiscal Utah Vehicle Sales Tax Talk From Ksl Cars

Salt Lake Utah Tax Deed Post Sale Review 306 000 Home Sells For 182k Youtube

Amazon Com Salt Lake County Utah Zip Codes 48 X 36 Paper Wall Map Office Products

Sales Taxes In The United States Wikipedia

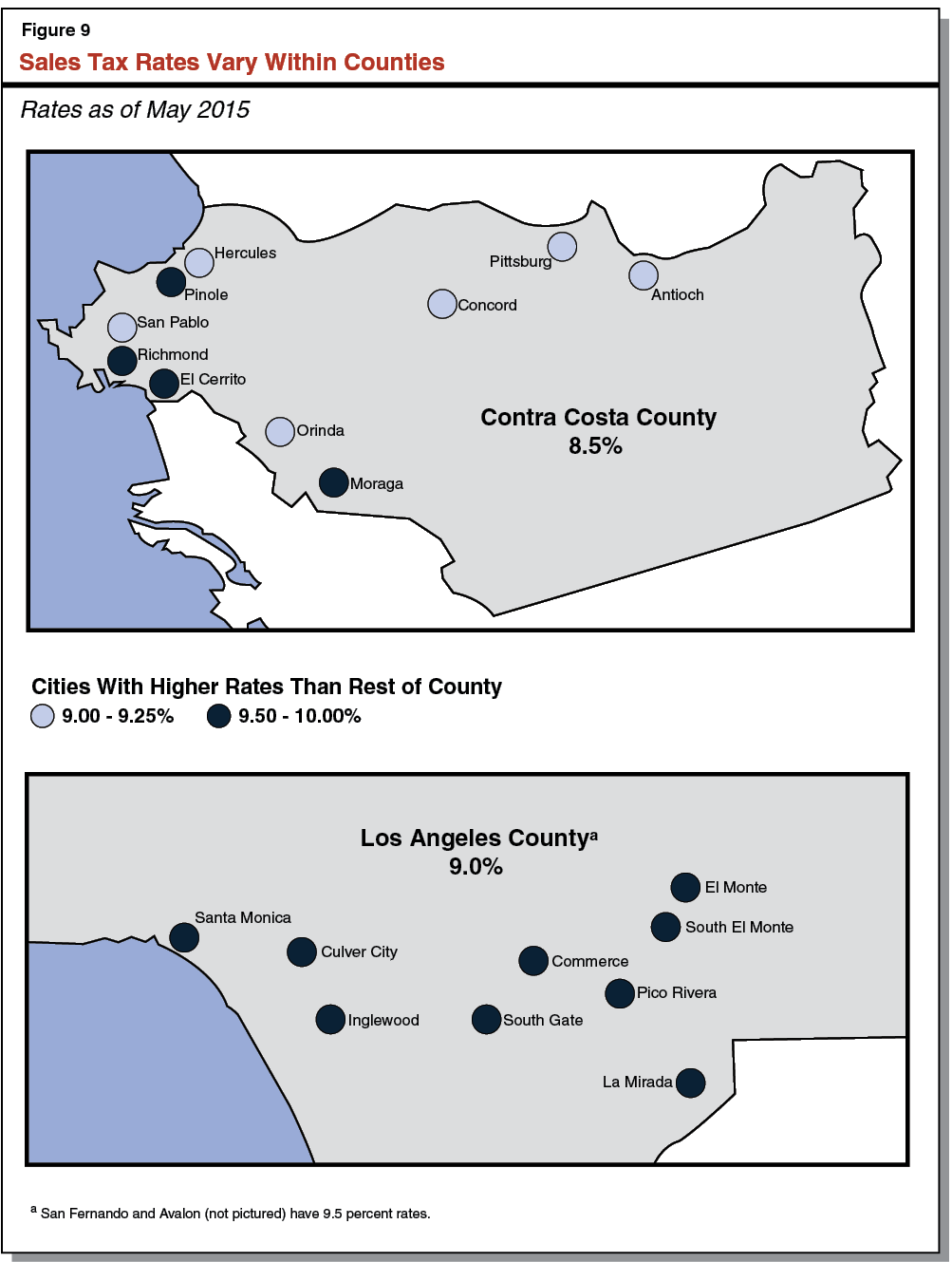

Understanding California S Sales Tax

Utah Sales Tax Calculator And Local Rates 2021 Wise

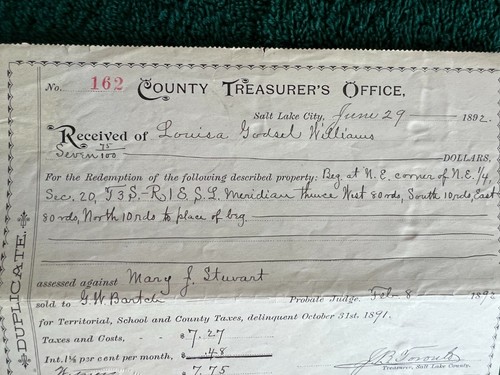

Taxes Salt Lake City Utah County Treasurer S Office June 29 1892 Ebay

Judy Weeks Rohner Utah Should Cut The Tax On Food Not The Income Tax

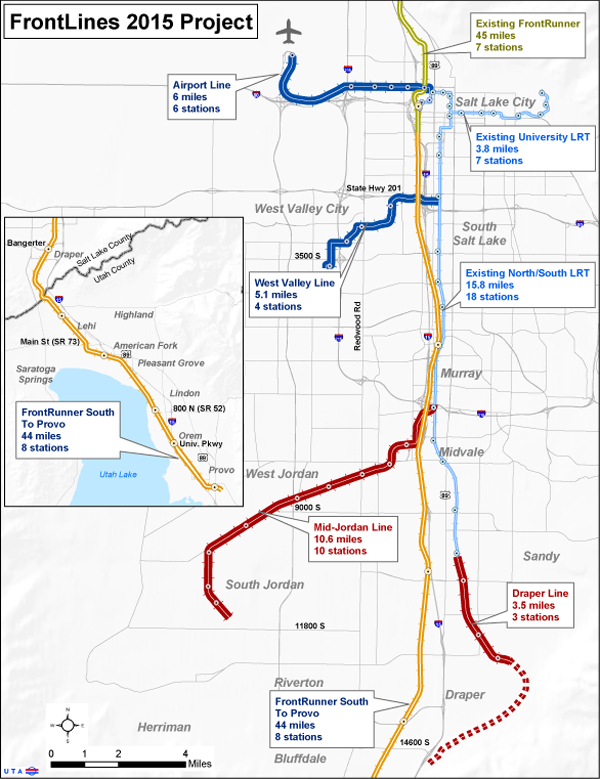

Transportation For America Salt Lake City Can Do Profile Transportation For America

The Two States Of Utah A Story Of Boom And Bust Deseret News

Prop 1 Could Widen Disparity In Utah Sales Taxes

Taxes In Orem Utah Orem Sales Tax Rates And Orem Property Tax Rates Orem Ut The Best Guide To Orem Utah